Insurance Check-Up Before the Year Ends: Are You Fully Covered?

As the year winds down, most homeowners start thinking about holiday plans, tax prep, and New Year goals. One task that rarely makes the list, but absolutely should, is reviewing your home insurance coverage.

In Destin and the surrounding Gulf Coast, water damage, fire hazards, storms, and humidity-related issues are year-round risks. If your policy isn’t up to date or doesn’t clearly outline what’s covered, you could be left with major out-of-pocket expenses when disaster strikes.

True North Restoration partners directly with your insurance provider, helping homeowners verify coverage, identify gaps, and properly document their property so claims go smoothly when it matters most.

Below is a simple, homeowner-friendly guide to help you get fully covered before the new year begins.

Why Year-End Is the Best Time for a Home Insurance Review

The final weeks of the year are the perfect reminder to make sure your home insurance still matches your real-life risks. A quick check-up now can prevent costly surprises later.

Key reasons to review your policy before January:

- Risks change over time: Small issues like leaks, worn roofing, or aging wiring can turn into major losses. If your policy isn't updated, you may be underinsured.

- Policies shift each year: Rates, limits, and exclusions often change. A year-end review helps you catch updates before a claim depends on them.

- Holidays increase hazards: Cooking fires, overloaded outlets, décor, guests, and winter storms make December one of the busiest months for insurance claims.

Taking a few minutes now to review your policy ensures you’re starting the new year fully protected and prepared.

1. Review Your Current Policy Line by Line

Many homeowners assume that “full coverage” means universal protection. Unfortunately, that’s rarely true.

Key areas to review:

- Dwelling coverage limits: Are they high enough for today’s construction costs?

- Water damage coverage: Not all policies cover leaks, intrusion, or burst pipes.

- Mold coverage: Florida humidity makes this essential.

- Fire and smoke remediation: Confirm cleanup and deodorization are included.

- Personal property limits: High-value items often need separate riders.

- Additional living expenses: Covers temporary lodging if your home becomes uninhabitable.

If anything looks vague, missing, or outdated, contact your insurer before the new year.

2. Identify Coverage Gaps You May Not Realize Exist

Common gaps include:

- Water damage exclusions or limited coverage

- Lack of flood protection (not included in standard policies)

- Low mold remediation limits

- Old replacement-cost valuations

- Exclusions for gradual leaks or long-term issues

If you're unsure what applies to your home, True North Restoration can

help you understand your risks clearly.

3. Document Your Home Before You Ever Need a Claim

Insurance companies rely on documentation—lots of it.

A year-end check-up should include:

A Home Inventory

Snap photos or record a quick walkthrough video showing major belongings, appliances, electronics, and valuables.

Photos of Existing Conditions

Document:

- Water stains

- Rust on plumbing

- Peeling paint

- Cracked drywall

- HVAC moisture issues

- Scorched outlets or breaker issues

These can serve as proof of the home’s pre-loss condition.

Record Upgrades

If you updated your roof, plumbing, or appliances this year, your insurer needs to know.

4. Understand What Your Insurance Company Needs During a Claim

Even the most cautious households benefit from preparation.

Consider these steps to protect your family and property:

- Smoke alarms: Test detectors on every floor and replace batteries annually.

- Fire extinguishers: Keep them accessible in key areas, especially the kitchen, and learn how to use them.

- Emergency plan: Ensure everyone in your household knows exit routes and assembly points.

- Professional support: If fire damage occurs, acting quickly with a trusted restoration company minimizes damage and speeds recovery.

At

True North Restoration, our team specializes in

fire damage restoration, guiding you through insurance processes and restoring your home safely to pre-fire condition.

Why Choose True North Restoration

Every carrier will ask for:

- Proof of loss

- Photos and videos

- Cause of damage

- Receipts for emergency mitigation

- Contractor estimates

True North Restoration works directly with all insurance companies, helping homeowners

avoid costly mistakes

during the claims process.

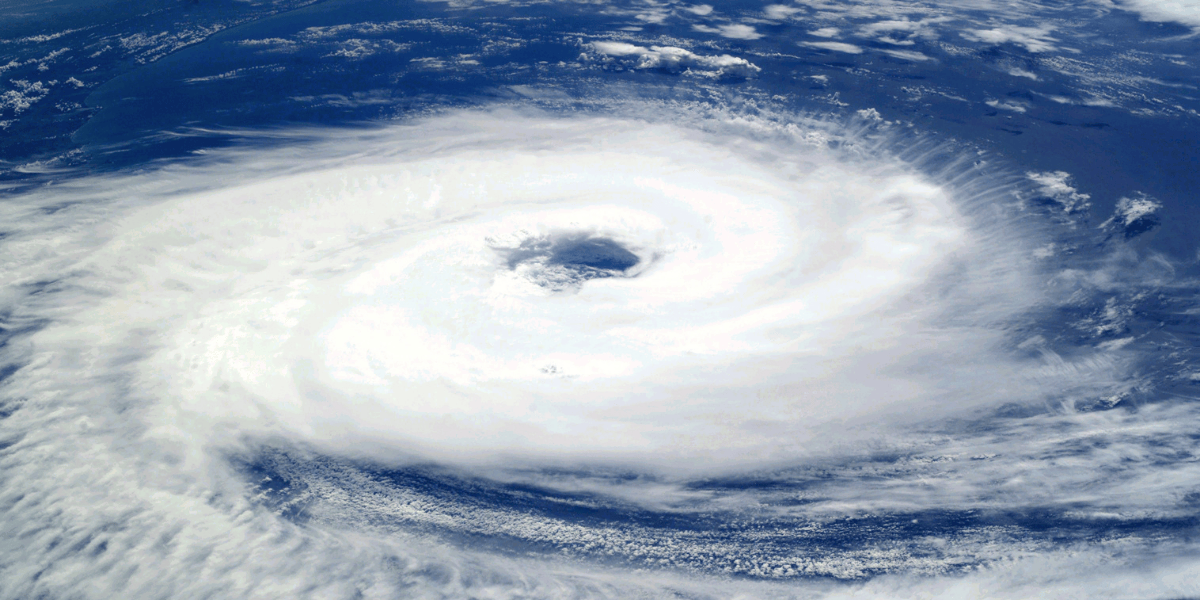

5. Evaluate Your Disaster Risks in the Gulf Coast Region

Living in Destin comes with unique hazards:

- Tropical storms and hurricane surges

- Sudden rainfall and drainage backups

- Salt-air corrosion on home systems

- Persistent humidity feeding mold growth

- Electrical hazards from seasonal decorations

Make sure your policy reflects the reality of where you live.

6. Schedule a Pre-Claim Property Assessment

A professional inspection is one of the smartest year-end moves.

A True North Restoration assessment can:

- Identify hidden water intrusion

- Detect mold early

- Uncover fire and electrical hazards

- Document your home’s condition for insurance files

- Provide evidence that insurers value during claims

7. Update Your Emergency Plan and Contacts

Before the new year:

- Confirm your insurance agent’s direct line

- Have your claim hotline saved in your phone

- Store your policy digitally and physically

- Add True North Restoration to your emergency contacts

When every minute counts, preparation matters.

Why Homeowners Trust True North Restoration

When disaster hits, you need a restoration partner who responds fast, handles the insurance headaches, and protects your home as if it were their own. That’s exactly why Gulf Coast homeowners rely on True North Restoration.

Here’s what sets them apart:

- 45-Minute On-Site Response – Faster help means less damage and a stronger insurance outcome.

- 24/7 Emergency Services – Disasters don’t wait, and neither does the True North team.

- Work Directly With All Insurance Companies – They document, communicate, and advocate on your behalf.

- Locally Owned in Destin, FL – They know the Gulf Coast’s unique risks better than anyone.

- Certified Restoration Specialists (IICRC) – Ensures your home is restored correctly and safely.

- Dedicated Project Managers – One point of contact guiding you from start to finish.

- Free Consultations – No-pressure assessments and expert recommendations.

When life throws you a curveball, True North Restoration is the team you want in your corner.

Get Peace of Mind Before the New Year Begins

A simple insurance check-up today can prevent massive headaches tomorrow. Whether you need help documenting your property, assessing risks, or restoring existing damage, True North Restoration is available 24/7.

Make sure you’re fully covered—and fully prepared.